Skrill Wallet Review 2026

148

A couple of years ago on my blog, I already discussed how to register with Moneybookers and how to withdraw money from Moneybookers. But time goes on, and things gradually change. Just last year, Moneybookers announced an upcoming rebranding of their brand.

The new name chosen for the payment system was Skrill Money Transfer. Honestly, I don’t even know where the name came from, what it means, or why the rebranding was needed. But, of course, no one asked for my opinion, so I’ll be using Skrill wallet to receive payments in 2026.

Along with the name change, the system owners organized a redesign of their website. This summer, the new version became available, so I thought it would be useful to provide a brief overview for those who are just starting to use Skrill.

So, let’s go over some general points about Skrill as of today. The Skrill Money Transfer (formerly Moneybookers) is quite popular among residents of Russia, Ukraine, Belarus, and other neighboring countries, primarily due to the restrictions imposed by PayPal for residents of these countries.

If you’re not aware, PayPal allows payments but makes it very difficult to receive money. In one of the blog articles, I wrote about the possible withdrawal of money from PayPal through Payoneer cards.

Meanwhile, Skrill Money Transfer allows normal operation without the hassle of multi-step schemes. It’s easy to send money, receive money, deposit into the system, and withdraw from it with minimal fees.

This year, this system has been very helpful for stock photographers, as all leading stock photo agencies on the internet are connected to it, allowing earnings to be received through it. Judging by the banners on the system’s website, various gambling sites are also connected to this system.

Alright, let’s get back to the beginning — let’s look at the registration of Skrill wallet.

Skrill registration

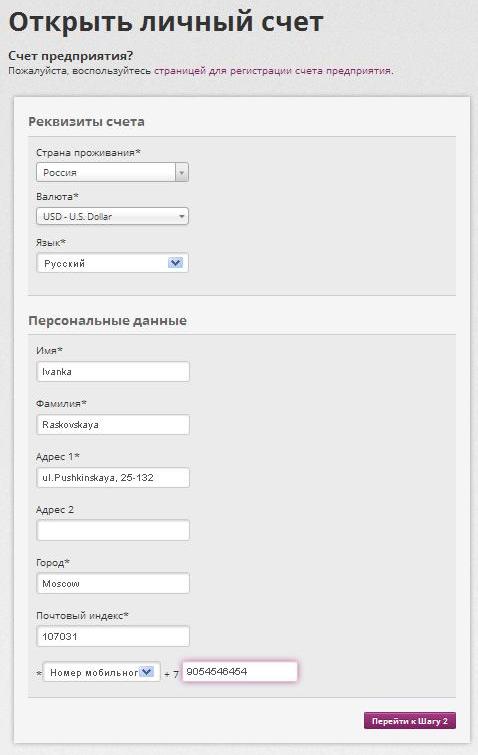

First, go to the system’s website by clicking the banner at the top of this article. The following window will appear:

If you need to change the interface language, click the relevant flag in the upper right corner. If everything is okay, then click the REGISTER button. A new window will open as shown below:

Here, you will need to enter all the required information. Note that everything should be filled out in Latin characters, i.e., in English letters.

Check the information you provided, and if everything is correct, click the “Proceed to Step 2” button.

I want to emphasize that you need to carefully check what you’ve entered in this form, as the verification email will be sent to these details.

If the information is incorrect or erroneous, the email won’t reach you, and you won’t pass full verification.

By the way, if you’re registering on the Skrill website as an entrepreneur or legal entity, intending to use the system for receiving payments or for transactions on your site, then click the link at the top of the form to register a business account.

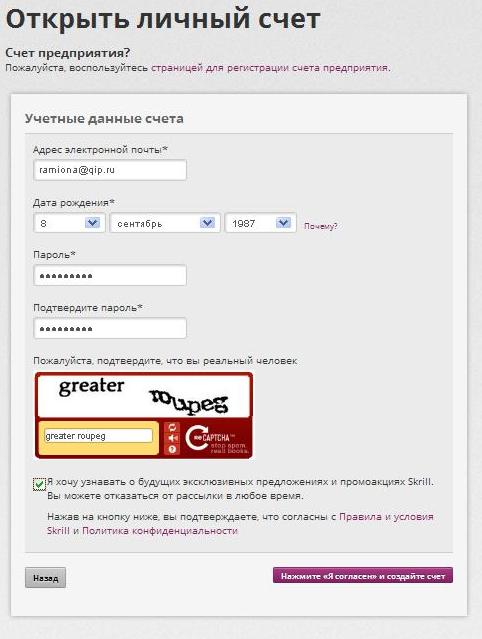

Returning to registration. In the second step, a window like this will appear:

Enter your email, date of birth, and password to log into the site. In Skrill Money Transfer, the email is used as a login in the future.

Don’t forget to tick the box next to the agreement to the system’s terms and policies.

Uncheck the box next to this item if you don’t want to receive system newsletters with various promotions and news.

If everything is done, then click the button at the bottom of the page, and the Skrill account will be created.

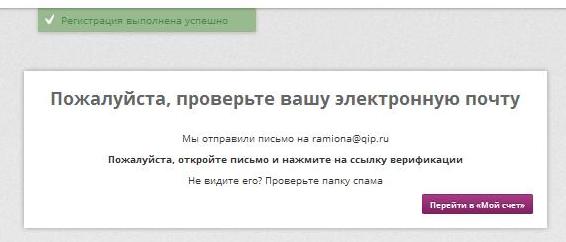

In the opened window, you’ll be notified that an email has been sent to your address. In this email, there will be a link you need to follow, which will verify the specified email.

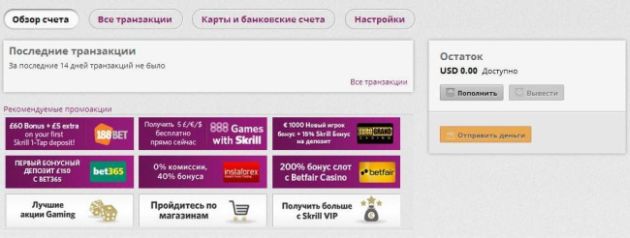

So, the email is verified, and you are in your Skrill wallet. The wallet overview tab displays transactions for the last 2 weeks, shows your account balance, and has buttons for depositing and withdrawing money from Skrill.

By the way, notice how many banners there are from gambling sites. I previously mentioned that the system is popular in this client category.

Where to next? I’d recommend going straight to the Settings section.

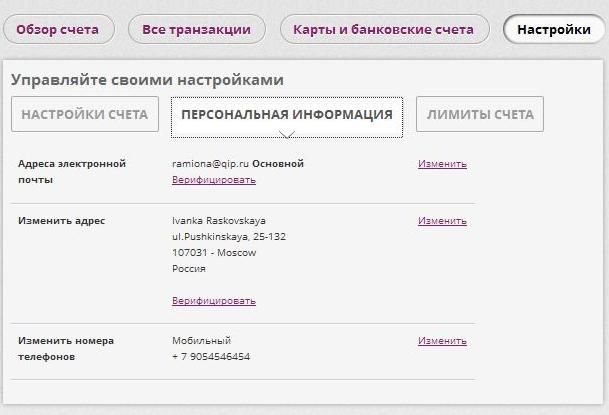

Then to the Personal Information tab.

Skrill Verification

As you can see, your information is displayed here, and there are links for verification. If you didn’t receive an email from Skrill, click the “Verify” link under the email.

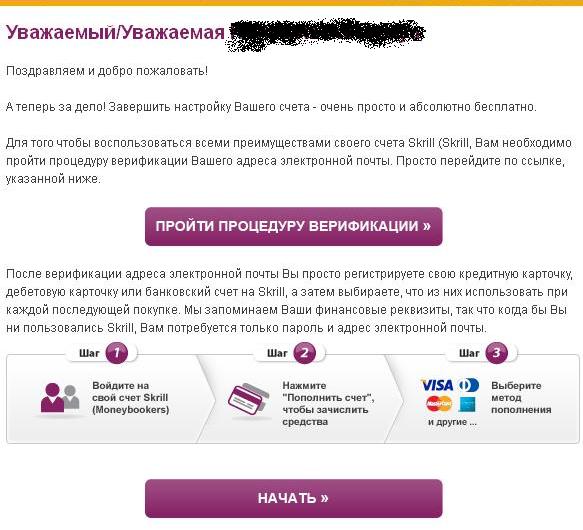

A window like this will open, where you click the “Proceed with Verification” button and check your email inbox:

In the personal settings window, you can also immediately request postal verification. Why?

Skrill wallet has certain transaction limits for depositing and withdrawing funds. The basic limits are quite low, and increasing them involves completing various verifications, including verifying your home address.

When you initiate this process, a letter with a code will be sent to your home address, which you will need to enter on the system’s website.

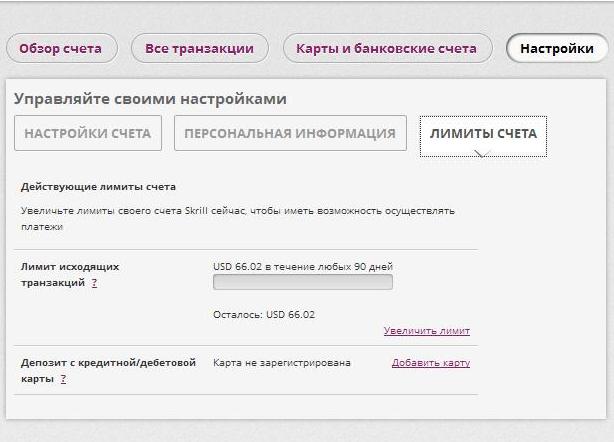

Now let’s look at the section on limits, which I mentioned in the previous paragraph:

As you can see from this screenshot, the basic limits are minimal, amounting to just over sixty dollars for 3 months.

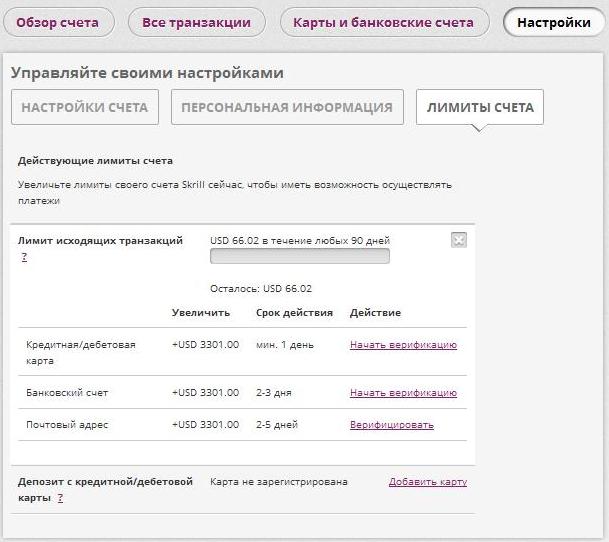

So, how do you increase your Skrill limits? Click on the link “Increase limit” to see how to raise Skrill’s basic limits.

One of them, which I’ve already mentioned, is address verification.

The other two are card verification and bank account verification.

How to Add a Card and Bank Account to Skrill

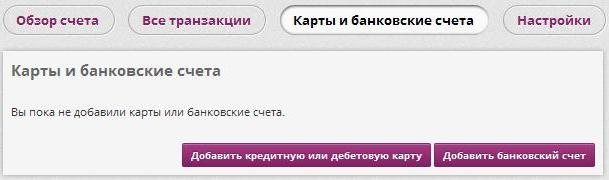

Essentially, the last two methods involve linking your account and card to Skrill Money Transfer, which can be done via the “Cards and Bank Accounts” section, where I am now heading:

Once again, it’s quite simple. In this window, select whether you want to add a card or an account and click the corresponding button.

How to Add a Bank Card

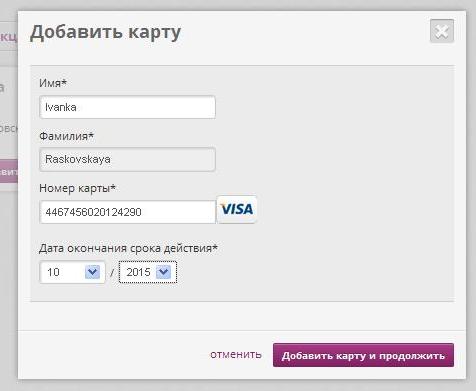

For example, adding a payment card looks like this:

Enter all required information from your bank card in the new window, then click the “Add card and continue” button.

After adding the card, it will need to be verified. Skrill card verification involves a deposit of your Skrill wallet in the sum of 1 to 3 dollars.

You’ll need to check with your bank to see the exact amount that was transferred, then enter it in the appropriate field in your Skrill account.

If the amount is correct, the funds will appear in your account balance, and the card status will change to “verified”. After this, limits will be raised to the specified amount in your account, and you’ll be able to withdraw money to the card from the system.

How to Add a Bank Account

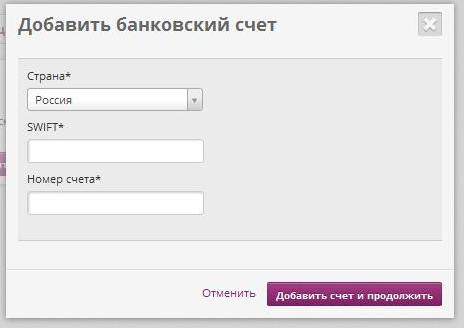

Adding and verifying a bank account is done as follows:

Specify your country, the bank’s SWIFT code, and the bank account number, then click the add button.

After adding the account to the wallet, you should also pass the verification for this bank account.

The verification procedure for the bank account is slightly different from that for a card since it involves a test withdrawal to the bank account.

When the money arrives in your bank, you see a verification code in the payment reference. You have to input it into the special field in your Skrill account. Once verified, your Skrill limits will be increased by the corresponding amount.

These procedures have remained the same since this information was published in the corresponding article about Moneybookers, so I won’t go into further detail here.

Skrill Transfers, Deposits, Withdrawals

So, what else is left to cover? Ah, deposits, withdrawals, and transfers through Skrill Money Transfer.

Let’s see how to do it.

In the account overview section on the right side of the window, you’ll find information on your account balance and three buttons for deposits, transfers, and withdrawals.

How to Fund Skrill

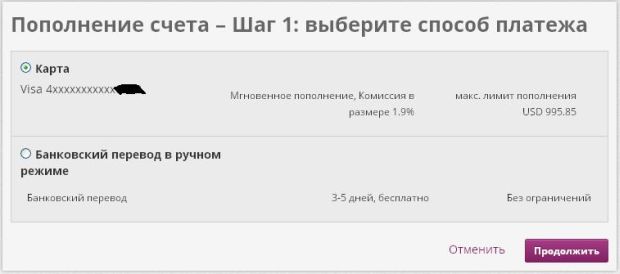

To fund your Skrill wallet, click the deposit button, and you’ll see a window like this:

You will need to select the deposit method, specify the amount, and click OK. If you’re depositing via a payment card, the process will be completed within about one minute.

If you’re depositing via a bank account, you’ll need to wait a few days (up to 5 business days).

Sending Money to Another Skrill User

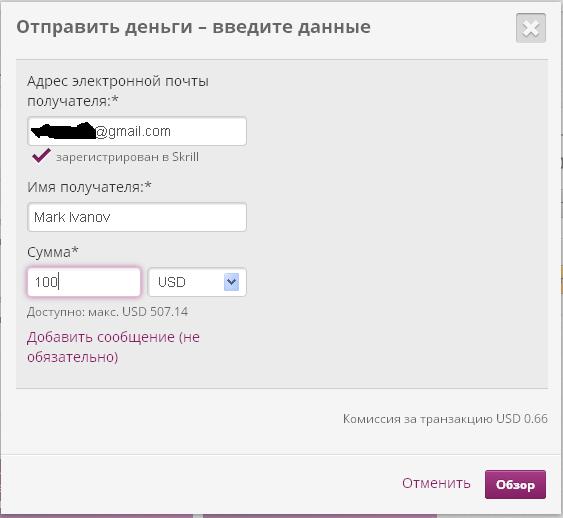

To transfer money to another Skrill account or make payments online, click the Transfer button, and the following window will open:

Here, you need to enter the user’s email or ID, the transfer amount, and the purpose of the transfer.

Note that you can send money even to users who do not have a Skrill account.

Simply provide the user’s email.

When a transfer is sent, the user will receive an email notification about the incoming funds and the need to open an account in the system to credit the transfer amount. The transfer itself is processed instantly.

Withdrawing Money from Skrill

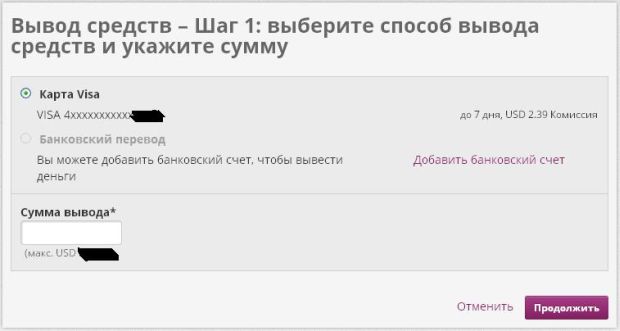

To withdraw money from Skrill, click on the withdrawal button:

A window will then appear offering a choice of withdrawal method, either to a card or an account.

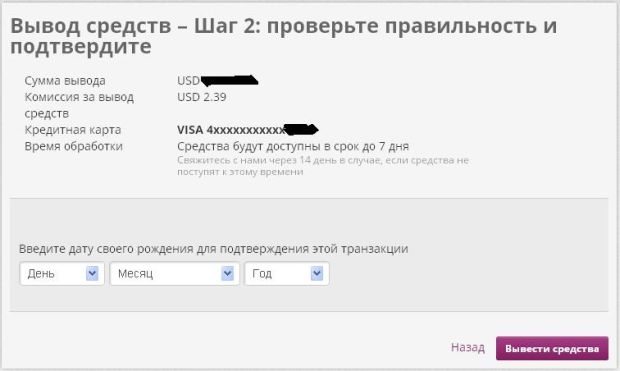

In this window, you also need to specify the amount, and if withdrawing to a card, you’ll need to enter the three-digit code located on the back of your card.

In the next window, you’ll need to enter your date of birth for additional verification, and that’s it.

Now, wait for the funds.

If the withdrawal is to a bank account, it may take up to 5 business days.

If withdrawing to a bank card, it usually takes about 4 business days, although the system advises up to 7 days, likely including weekends.

That’s how easy it is to use the Skrill Money Transfer; it seems pretty straightforward to me.

Basic Skrill Fees

Regarding fees: Internal transfers cost the sender 1.9% (but no more than 10 euros), with no charges for the recipient.

Funding your Skrill account via payment card incurs a fee starting at 2.5% while funding from a bank account is free of charge.

Withdrawing funds from a Skrill wallet incurs a fee of at least 4.99%, with a minimum charge of 2.95 euros per withdrawal transaction.

Note that these are Skrill’s fees, and there may be additional fees charged by your bank, which you’ll need to check on your own.

That’s pretty much all the information you need. If you have any questions, feel free to ask in the comments section, and I’ll try to answer as soon as possible.

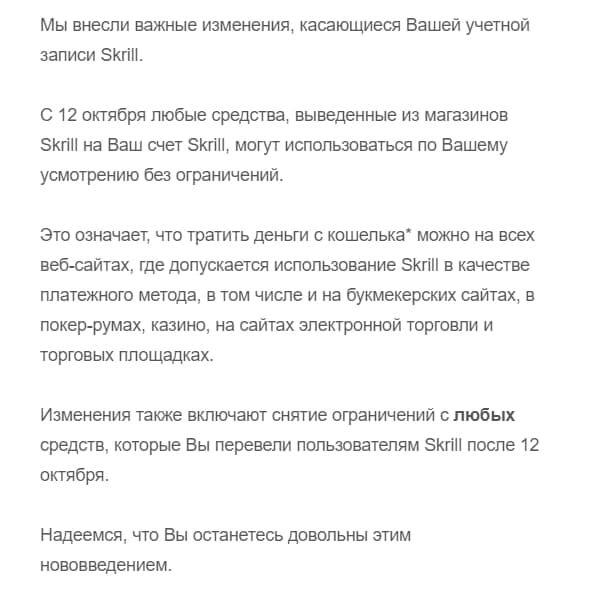

Update on Skrill Terms in 2021

Significant changes were made to Skrill’s policy on deposits and withdrawals in October 2021.

Starting from October 12, Skrill no longer separates funds in the balance into gambling(gaming) and non-gambling purpose.

For those who use this payment system to deposit or withdraw to accounts on gambling sites, this is an important update.

For others, this is also significant, as many were confused about why Skrill would ask the purpose of funds transferred to the wallet.

Hello, I have a verification problem with Skrill. Through the app, I can only take a photo of the document and they keep rejecting it, saying it’s not visible. They suggest uploading a file from the computer, but I have a completely different interface in my personal account, there’s no button to upload the document.. and I keep submitting the same thing over and over. It’s endless. How do I attach a scan of the document? If I don’t even have such an option.

Good day!

I faced the same problem when I got rejected through the Skrill app. I wrote to support describing the issue, and they suggested I send a scan via email. Try to describe the problem to them and suggest providing the scan in another way; perhaps this will help resolve the issue.

Hello, I have a problem with verification. Through the Skrill app, I can only take a photo of the document and they keep rejecting it, saying it’s not visible. They suggest uploading a file from the computer, but I have a completely different interface in my personal account, there’s no such option.

Good day, could you please tell me how to properly take a photo of my passport? I have already sent a photo of two pages of my passport three times and every time it was rejected. I am from Ukraine.

Good day.

Alexandra, try installing their mobile application and verify through it. The link to Skrill’s application is on this page: https://www.skrill.com/ru/new-account-verification/

Good day!)

Please help me figure this out.

There was an account in MoneyBookers. Payments were made automatically to it. I haven’t logged in there for a long time and didn’t check. The money has left the stock. And then MoneyBookers ceased to exist, it became Skrill… and there is no money there))) And now I don’t understand what to do))) I would be grateful if you know what to do in this situation and share your thoughts. Thank you!

Good day, Yulia!

Most likely, the money from your account was deducted by Skrill itself as a fee for maintaining an inactive account. Currently, it is 5 euros/month; I can’t remember what the fee was before. Here is a description of this fee:

“No fees are charged for personal use of the Skrill payment system if the user has logged into their account or made at least one transaction during the last 12 months.

Otherwise, a maintenance fee of 5.00 euros (or the equivalent of that amount) will be deducted monthly from the account balance.”

If this has happened, the money can no longer be returned. In the future, set yourself a reminder to log into your Skrill account at least once a quarter. And don’t forget to review changes in the terms of service (they send notifications about changes) so you don’t miss important updates.

Hello. I cannot withdraw money from Skrill to my ruble account in Russia. They say there’s a technical problem and the transaction was canceled. Previously, they blocked transfers to my foreign currency account in Russia. It seems they will block my ruble account too. How can I withdraw funds?

Good afternoon, Victor. Most likely, this is related to the restrictions that Russian banks impose on transactions for deposits and withdrawals from Skrill. As an option for withdrawal, you might try exchanging dollars from Skrill to WebMoney. Here is a great service https://exchanger.money/emoney/home/skrill, where you can exchange Skrill for WebMoney, and then withdraw from WebMoney to a card or bank account in Russia without any problems.

Thank you. I just don’t understand how to exchange them from Skrill. Maybe someone wrote instructions for this earlier. Please send me a link. And how does registration and withdrawal work in WebMoney in Russia? If you’re interested, I found an article about payments in Russia. They’re probably going to close them all soon if you receive them without paying taxes.

Viktor, you need a wallet in Webmoney. If you have a wallet, then log in to exchanger.money using the certificate with which you access Webmoney. In the appropriate section, either choose a request that suits you by amount and rate, or click “create a new one” and do it as you wish. If you have already selected from existing requests, you will see what is required from you. Usually, the procedure is as follows: you accept the request, you are given the wallet details in Skrill, to which you must transfer your Skrill dollars or euros. After completing the transfer, confirm in the request that you have completed your part of the transaction. Your counterparty must confirm on their end that they received the specified amount, and then the specified amount of WMZ will be transferred to your Webmoney wallet. To avoid fraud, the guarantee usually happens by instantly blocking the specified amount of WMZ in the request by the exchanger.money service from the moment the exchange begins.

Then, when you have WMZ in your wallet, you can similarly withdraw rubles to a bank card in the section https://exchanger.money/cards/home/wmz. Plus, with Webmoney, you can order a card that you can withdraw from. In addition, you can withdraw WMZ through transfer systems like Western Union, Contact, Golden Crown, Unistream, and MoneyGram. Withdrawal requests from Webmoney through transfer systems are available in sufficient quantity at https://exchanger.money/sdp/home/all. In general, everything is quite accessible.

Hello, on December 16, 2019, I withdrew funds from my Skrill account to a bank account at Kaspi Bank in Kazakhstan. This was and is the very first transfer. Seven days have already passed, but the funds have not yet arrived in my bank account. Could you please tell me what could be the reasons, or is this something that happens often??? Have you encountered such a situation??? Thank you in advance, Olga!!!

Good afternoon, Marat.

If the transfer from Skrill was to a bank account, it may take up to 5-7 working (banking) days to process. However, it usually takes 3 days. Considering the weekends, you can wait a couple more days.

But still, please check with your bank to see if the money has arrived in your name. Ask them to check for any transfers in your name that might be pending clarification. There is a possibility that the money arrived, but some details were entered incorrectly, and the funds are pending on the bank’s transit account until clarification. In some banks, in such a situation, the bank itself sends a request to the sender for clarification of the transfer details, and the recipient is not even informed that there is a problem. I have faced a similar situation myself. The bank’s position in this case is as follows: as long as the money is not credited to your account, you have no relationship with it, and all details are agreed upon with the sender. If your bank does not have the funds and sufficient time has passed, then write to Skrill support listing your actions (contacted the bank, checked the account balance, etc.) so that they can start looking into it on their side.

Hello, if someone can help me, please write.

I sent money to my Qiwi wallet through a bookmaker company.

Skrill told me that you cannot send money.

Skrill notifies you that just now, when trying to transfer $2667.5 to your account, error № E19 occurred.

Error № E19 means that your payment system is not linked to our transfer system and cannot accept amounts of that size.

To link your electronic wallet to our payment system, you need to pay a linking fee of $86.

The payment must be made by 04.12.2019 18:00 MSK, through the Qiwi payment system.

The linking to our system is done once and is permanently associated with your details for subsequent payments.

After payment, the funds will automatically be credited to your account. We expect payment on time!

Payment details: Qiwi: +79; Payeer: P10; Yandex Money: 4100

Good afternoon.

This is the first time I’m hearing about this.

Hello. I have not been able to withdraw money to my ruble account in Russia from Skrill for 7 days. They say technical issues. It seems they have blocked it. What options do I have to withdraw funds to Russia?

OLGA!

I WANT TO USE THIS PAYMENT SYSTEM. I LIVE IN BELARUS. ARE THERE ANY PROBLEMS WITH WITHDRAWING MONEY IN THIS COUNTRY?

IF THERE ARE, PLEASE TELL ME HOW TO AVOID THEM.

THANK YOU.

Vadim, withdrawing money from Skrill in Belarus works fine according to reviews. I am from another country, but based on reviews, this payment system is suitable for Belarusians.

Good day, Olga! I have a problem with withdrawing money to a card (Sber Visa), during the card verification Skrill asks to top up the account by $2.23 from the card, but Sber blocks the top-up request – I receive an SMS message: “Payment of $2.23 in favor of an establishment engaged in gambling activities is not completed according to Federal Law No. 244.” I wrote to Skrill support, the response was: “The condition to top up the account with a Visa card for ‘gambling purposes’ is a technical requirement of our system to activate the card for money withdrawal.” I called Sber, the response was: Federal Law No. 244 is a state requirement; they are not to blame… What should I do?!

Good afternoon, Alex! Try not to check the “for gambling purposes” box. But in this case, you won’t be able to withdraw money from Skrill that you received from gambling activities. As an alternative for withdrawal, you can consider withdrawing from Skrill to Payoneer.

Could you please tell me? Should the Privatbank card be real or can it be virtual? I faced a problem – the virtual card passed verification, but when I tried to fund the Skrill account, it says that funding is not possible.

Alexander, Privatbank has not allowed Ukrainians to work with Skrill for several years, so use cards from another bank.

Skrill unexpectedly deducted nearly $3 from my card for verification without my consent. The verification went through, but the money never returned to my card and remains in my Skrill account. Now, to withdraw, I need a Visa card or to open another bank account, although I already have one. I think the policy of this payment system is incorrect. If verification is completed and money is taken without consent, they should return it without any fees, which are, by the way, very high. I’ve never encountered such high fees on any other payment system. I wouldn’t recommend this payment system to anyone.

Good day!

Interesting article, useful. However, I would like to note that transferring money through exchange services remains one of the most profitable options. But it’s worth remembering that exchange rates are constantly changing!

Any monitoring website could be a solution. I’ve been using them for over 5 years.

I find the lowest commission and transfer the money. It’s much cheaper than any internal transfers. I recommend it to you too!

Hello! I have a problem withdrawing money. I’ve done it before, but this time it asks to verify my account and upload documents. How should I upload them correctly? If it’s a passport, it asks to scan all sides, but it only accepts one file. Please advise. Thank you!

Good afternoon!

Irina, when scanning, create a multipage document or combine several documents (PDF) into one, as it is described here: https://helpx.adobe.com/ru/acrobat/using/merging-files-single-pdf.html.

Skrill is a scam; they quietly extort your money, do not get involved with them, I never received my funds, plus they took almost 4 dollars for verification and several dollars for the transfer. Skrill only has negative reviews.

Vladimir, did you try to find out with support?

On the recommendation of *Trade, I registered an account with Skrill, where *Trade transferred my 7509.00 USD. I passed verification, everything was as required. But! I cannot withdraw the money to my bank account, not a single penny. The support seems to not hear my questions and answers randomly. Tomorrow I will call, but I think the phone will always be busy. It really seems like a scam.

What should I do? Can someone advise?

Oleg, they usually don’t respond very quickly via email or the request form on the website. Try calling support. In the article at https://microstock.top/finansy/krazha-deneg-skrill-chto-delat/, I described my experience contacting Skrill support; there are also all the working phone numbers. Try to communicate and find out what the problem is. Perhaps you have some limit on withdrawals. Have you tried to request a withdrawal of 100-200 dollars just to see if it works?

I don’t understand the sequence of actions; I’m a beginner, FROM Russia: first, I need to get a Visa card from some decent bank (Sberbank or VTB-24, there are no other decent ones, I think), and only after that register on Skrill, and then link my bank card to my Skrill account, is that how I understood it? I intend to make only one operation: withdraw the money earned from Audiojungle (I’m a composer). It’s very hard to understand when you’re not a banking employee and you’re well past 18, your mind isn’t what it used to be)) Everything is very complicated(((

Natalia, you can do it in whatever sequence is convenient for you: register on Skrill, then open a card at one of the banks and link it to your Skrill account. You can open the card first, then the Skrill account. The main thing is that the bank properly processes such transactions and the verification procedure goes smoothly.

Good afternoon, could you please tell me if verifying the email address only increases the Skrill limit?

Is it possible to withdraw funds through Skrill only to a card and account, and not to payment systems like Yandex Money, etc.?

Good afternoon!

Yes, mainly for increasing the limit.

Withdrawals can only be made to a card or a bank account; other systems can only be attempted through some intermediaries.

Good afternoon! I am from Ukraine. Could you please tell me which bank and which card is best to register for withdrawing money from Skrill? I read that someone withdrew $50 from Skrill, but it arrived on their PrivatBank card $20 less.

Good afternoon!

It’s better not to deal with PrivatBank regarding Skrill, as they sometimes have crazy issues in this regard. Check out the cards from Sberbank, Raiffeisenbank, or UkrSibbank.

Hello! I am from Ukraine, and this is my first time withdrawing money from Skrill. During the withdrawal to the card, I passed the first verification. $1.1 was deducted from my card account and credited to my Skrill account. But during another verification required by the system, I cannot pass it. It says I need to enter a code, and the system will deduct $2.6. Please tell me what the reason is? After several initial attempts, I waited for the weekend. I repeated it and there were no changes. I wrote to customer support, but no one responded.

I decided to bypass it and topped up my Skrill account, but nothing changed.

Please tell me what the reason is?

Good afternoon, Stanislav!

I haven’t heard about the second verification until now. Usually, the system deducts an amount from the card, then you find out this amount and enter it on the website. If everything is entered correctly, the card is verified and you can withdraw. I haven’t encountered requests for codes or a second verification, and I haven’t heard about this anywhere.

I can withdraw without problems 😉

I have a problem with withdrawing funds. The card verification on Skrill went smoothly, but when trying to withdraw funds to it in the withdrawal section, it showed Verify again. I re-verified it, already transferring the amount within the specified range to the Skrill account. Both transactions (first and second verifications) are displayed, but the withdrawal of funds is still unavailable, and next to the card, it says verify (in the withdrawal section), while in the cards and bank accounts section, this card is shown as verified.

Can you tell me what the problem might be?

Lina, did you find out from the bank how much was blocked after the first verification and entered that amount in the verification field?

Is it possible to transfer money from PayPal to a Skrill account?

How to transfer money from PayPal to a Skrill account?

Only if there is some intermediary. Directly, it’s not possible.

Hello! Please tell me, has anyone replenished a Skrill account with a card (or activated a card) and withdrawn money to a VISA card in the last two weeks? Have they disabled these services for everyone or am I the only one with this issue? I’ve passed all verifications, all limits have been removed, but I still can’t withdraw money to my card. Communication with customer support has been fruitless; today I can’t even contact them (wait, all operators are busy…), it feels like they just don’t want to talk.

Good afternoon!

I withdrew for the last time at the end of May and had no problems.

Thank you, Olga, you were very helpful!!! It may help someone else to contact customer support; communication in Russian is only available at the number +7 495 249 5439

Hello. Could you please tell me the phone number of customer support? I called them six months ago, but I didn’t save the number, unfortunately. I added a new card, passed verification, but I can’t withdraw my money.

Good afternoon, Irina!

Here: +7 495 249 5439 / +44 203 308 2520 Mon – Wed 09:00 – 18:00 GMT

The same story as many others. A few years I was withdrawing to an account, everything verified – it’s been a month and $180 is still hanging. Customer support is completely unresponsive. I can’t pay anything either. Everyone should be careful!

Olya, did I understand correctly that the most beneficial way is:

if replenishing the account, then from a bank account.

if withdrawing money, then to a bank card?

So, I need to register both?

Natalia, if we consider the fees charged by Skrill, replenishing from an account looks more appealing. But, all of this is relative, as your bank will definitely charge its fee for a SWIFT payment, but for a payment from a card (if the card is in the same currency as the Skrill account), the bank will charge nothing. And here, you just need to grab a calculator and calculate based on how much you want to deposit into Skrill. In my opinion, for small deposits, it is better to use a card, while for larger amounts, replenishing from an account will most likely be more beneficial.

As for withdrawals, I think a card is more advantageous here.

VTB24 doesn’t work with Skrill, and thus I cannot verify my card. Useless system.

Well, yes, it depends on which perspective you look at it from. For me, in this case, VTB24 is useless since it doesn’t provide the client with a fully functional service with such limitations.

Could you please tell me how to withdraw money from Skrill without verification? There is a limit on the amount of money, but it can be withdrawn.

You can try to withdraw money to a bank account instead of a card. In this case, preliminary verification is not required as it is for card withdrawals. Or you can try transferring money to the account of a user who is already verified on Skrill.

How can I withdraw money from Skrill without verification? There are limits on the amount, but it can be withdrawn. This is not described anywhere.

Olya, sorry, I read it again; you already answered the question in your first reply))

So: lower loss amount – withdrawal to a card, and if I use my method, then larger amounts when withdrawing (from 500 USD).

Yes, using a card is simpler in terms of commission losses: there is a standard Skrill fee + your bank’s fee for depositing funds onto the card (0-1% of the amount) and that’s it. By the way, also pay attention to ensure that the card is in the same currency as the account on Skrill to avoid losses from conversions.

Olya, thank you for your response. Honestly, I didn’t suspect this; I thought I would save on card service fees and created a savings account (online), actually withdrawing the amount there, which is not large; I thought to gradually save by earning interest, but these percentage losses, even on small amounts, create a rather sad picture for withdrawing money. I will request information from Sber, but I understand that this won’t increase the amount…:(

I understand that when withdrawing from Skrill to a card, this path is shortened? And the losses are minimized?

Thank you again for the detailed answer.

Good day!

Thank you for the detailed description of the processes.

I sent money to my account at Sber the other day, and today the amount arrived, but not all of it. It should have been 74.46, but only 49.46 arrived in the account. Has this happened before?

Could you tell me where I can write regarding this issue?

Good day, Ekaterina!

I understand that you made a withdrawal to your account, not to a card. When withdrawing to an account, the money goes through the SWIFT system via a chain of correspondent banks, each of which has the right to take a piece of commission. At the same time, neither Skrill nor Sber (may slightly) participate in this payment union. You can try to request information from Sber regarding this transfer, and in the SWIFT, you can sometimes see the whole chain. This happens regularly, and usually, the total commission amounts range from $10 to several dozen dollars. So, pay attention to the fact that it’s optimal to withdraw amounts of at least $500. Then, the proportion of commissions to the size of the transfer is about 2-7%. Generally, if you want to avoid such losses, it’s better to withdraw to a card.

Good day! Can you tell me how long it takes to review the filled-out online form on the Skrill website (account verification)? And is there an email to send my information for a quicker review?

Good day, Dmitry!

Typically, the response came within 2-3 days to the registration email. It’s hard to say how it is now, but I think it’s unlikely to be faster.

Hello, you described everything very clearly, thank you.

But I have one question left: how to accept payments via Skrill from cards, not just from the system, i.e., when a person chooses this system to pay for my product, he is offered to pay from his Skrill account, but it needs to allow him to pay directly from the card without a Skrill account. How can I set this up? Thank you!

Good day, Sergey!

To accept card payments, I believe you need to obtain something like a virtual terminal form from Skrill. But I can’t advise you more accurately since I accepted payments from other accounts, unfortunately not from cards. However, Skrill does offer functionality for this, so try to check here: https://www.skrill.com/ru/biznes/shopping-carts/x-cart/, and I think you will find everything you need there.

Good day, Olya! Thank you for the detailed description! One thing I don’t quite understand. Should the VISA card be in dollars? Or is it not necessary, and can it be in rubles?

Good day, Pavel!

Yes, it can be in rubles or euros as well. Just check with the bank: can the card be used for transactions in other currencies? Ideally, it should be in dollars or euros, depending on the currency of your Skrill account. If the currency of the card differs, then when the money arrives, there is usually a conversion. And usually, the conversion is at a rather unfavorable rate for the client, plus a conversion fee may also be charged.

salalm

Stuck $180 in Skrill – they won’t let me withdraw to the card, and they don’t respond to requests. Please advise how else I can withdraw or where to pay without verification. I should note that previously, I was able to withdraw money to the same bank card without issues.

You can try transferring it to another Skrill account where there are no withdrawal issues.

Hello! I can no longer withdraw funds to my bank account and card. When I contacted Skrill support, I was advised to fill out a special form to verify my address for my bank. I completed it with the bank’s help. Then I sent the file back on the provided contact form. I’ve done everything they required of me! But it’s been more than 20 days, and I still haven’t received any response, and withdrawing funds is still impossible!

The Skrill form was offered as an alternative to other documents since I am temporarily living in another city, at an unregistered address. Due to military actions, the postal service is not operational in my city (Donetsk).

Good day, Ella!

Honestly, I have not encountered such a verification form. Have you clarified with Skrill support if they still need anything from you? In general, 20 days is enough time for them to check what you sent them. Perhaps something was filled out incorrectly in the form provided by Skrill? In any case, you’ll need to push their support.

Hello! Please help with this question!

I can no longer withdraw funds to my bank account and card. When I contacted Skrill support, I was advised to download a special form from Skrill to verify my address. I filled it out with my bank’s assistance. I sent it back on the provided form. I’ve done everything they required of me! But it’s been almost a month, and I still can’t withdraw funds!

My question is: should I receive a notification from Skrill, and within what timeframe?

Currently, I am temporarily living at an unregistered address, at the other end of Ukraine, since in my city (Donetsk) there is war and the postal service for correspondence is not functioning.

Happy New Year 2015 in advance!! Has anyone in BELARUS received or topped up their Skrill account?

Olya, good afternoon! Could you please tell me which banks in Ukraine (bank cards) work best with Skrill for depositing and withdrawing funds? Thank you.

Good afternoon, Andrey!

As far as I know, among the major ones, Alfa works fine. I’ve also heard mentions of UkrSibBank and Raiffeisen Bank.

As for those that are better avoided: in the last couple of years, there has been a lot of negativity reported about withdrawals from Skrill to PrivatBank cards.

Help me, I registered and verified my email without any problems. I log into Skrill with my email and password, but the menu at the top of the screen is almost empty. There are no “Account Overview,” “Settings,” “Cards and Bank Accounts.” There is only Logout, Help, My Account. I registered yesterday. Maybe I need to give them time to verify my data? What could this be?

Alik, have you tried clearing your browser cache?

What can happen if I exceed the 60-day limit on Skrill (when withdrawing an amount exceeding this limit)?

Olga, based on previous experience, you had to wait until the limit was restored. Have you tried writing a request to support regarding increasing the limit?

Hello, I cannot verify the Visa credit card from “Oshchadbank” in the Skrill payment system. It says – “verification failed, please contact us.” Can you advise what to do?

Do I need to enable the “Automatic payment acceptance” option? And can I withdraw money from the stock to my Skrill account immediately after opening the account and verifying my email?

Ilya, you can start receiving money on Skrill right after opening the account. Skrill has a feature that allows you to send money to someone who doesn’t have an account. 🙂

Thank you for this article! I’ve been looking for an accessible online service to receive payments in Ukraine. Guys, can you tell me if Skrill works well with Privat Bank cards? Are funds withdrawn without any issues? Thank you in advance)

Irina, it’s better not to get involved with Privatbank, as they blocked incoming payments from Moneybookers to accounts throughout 2012-2013.

Thanks for the info. Registration does not go through in Mozilla, but it works fine in IE.

Hmm, I don’t even know what this is related to. I registered through Mozilla back in the day.

Could you tell me if I withdrew to PUMB from Skrill and didn’t specify the funds for gaming purposes, will the money now not arrive? How can I fix the situation? Can I use this card and rewrite it for gaming purposes? Will the money come if dollars go to the hryvnia card, considering that PUMB bank does not convert? Thank you

Katya, if Skrill processed your withdrawal payment, everything should work fine. Again, in normal banks, the conversion process for card transactions is usually automated, and everything should be credited to your card at the hryvnia rate. After ordering the withdrawal, check the card balance after 4-5 business days. Then you will be able to determine whether your PUMB converts such transfers or not. I have encountered such responses from operators before about what they do not do, and then it turned out that everything was fine.

You can remove the card from the list in your account and then try to add it again. However, for proper removal, you usually need to contact support to clean up the records in their database.

Hello, I registered a business account to receive payments through the website. I provided the company’s account, and for account verification, Skrill asks for a bank statement for the last three months. Is it worth sending a blank statement if there have been no transactions in the last three months?

Good afternoon!

Try it. They need the statement primarily to verify your address, not to check your turnover. If it doesn’t go through, then you’ll have to think about what to give them instead of the statement. Make sure that the bank’s stamp is on the statement.

Olya, thank you very much for such a detailed and quick response!

Could you tell me when this “terrible” moment will occur… is it worth switching to PayPal?

Alexey, in the event of such a situation, you have several options. You can stay on your current account as a merchant and additionally lose up to 3% on Moneybookers’ commissions. For small amounts of a few hundred dollars, this might not be noticeable. The second option is to register a new account under someone else’s name or yourself, but you will need a new card or bank account for withdrawals. The third option is to switch to other payment methods like PayPal, Payoneer, etc.

Could you please tell me how to avoid getting a merchant status on Moneybookers?

Alexey, according to Moneybookers’ rules, “freelancers (web designers, developers, translators, photographers, etc.) are considered commercial users.” So, it’s unlikely to avoid it. Some manage to use Moneybookers for years while processing decent amounts, but some get the merchant status just a few months after starting. As an option, you can register a new account under a relative’s name and withdraw to that account. However, this is also just a temporary measure until Moneybookers decides to change the account status. It was mentioned on some forums that you can try to diversify transactions on the account (pay for purchases, receive internal transfers within the system, withdraw money irregularly instead of every month, and create a staggered payout pace) to delay getting the merchant status as much as possible.

Could you please tell me how to avoid getting a merchant status on Moneybookers?

Could you please clarify this: the money arrived in the total amount but is not reflected in the available balance; how can I withdraw it?

I didn’t quite understand you, what do you mean by the total amount?

Olya, could you please advise on the following:

In the Skrill account settings, there is an option “automatic receipt of money.” For some reason, it is disabled by default. Logically, it should be enabled. What about you? Are there any nuances?

Thank you.

Sergey, when I opened my account, Moneybookers was still around, and that option didn’t exist. I just checked my settings, and I have it set to “connected.” So I believe it can be enabled.

Can I use Skrill without having a bank account?

Yes, you can.

Olya, thank you very much for the detailed and informative article.

Please tell me, how long can I not link a card to Skrill?

(for example, if I don’t have one yet).

Sergey, yes, you can link it when you need to withdraw or deposit money into your account. Transfers within the system can be made without a card, as well as receiving money on your account from other participants in the system.

Please tell me, if I have a Maestro card, can I use it to top up my account in Skrill? I tried, but it didn’t work. Are there any other ways (besides bank transfer and card) to deposit funds into SKRILL? Please advise.

Oleg, nothing will work with Maestro. You need either a Visa or a MasterCard. If you don’t want to deal with the bank, you can try using Qiwi at visa.qiwi.com/qvv/buy.action.

Will a Sberbank Visa Electron be suitable for withdrawing money? Does the account have to be in dollars? Is it not possible in rubles?

Nadezhda, it should work, but if memory serves me right, there was a comment somewhere about some issues with Sberbank. Generally, the currency of the card doesn’t matter, as an automatic conversion is usually performed when crediting or debiting the card. The main downside in the case of a currency mismatch between the card and the payment processor is the conversion at an unfavorable rate, and sometimes banks also charge an additional conversion fee.

Hello.

I cannot verify my debit card. It seems I’m doing everything correctly. In the window to add a debit card, I enter the card number (MasterCard) and CSC, then a window follows saying “Step 1 verify the card, etc.” … then a red bar with the message – Card verification failed. Please contact us. It’s unclear how to understand this… the account seems to be verified! … because of this, I cannot withdraw money… Thank you

Hello!

Dmitry, did you try writing to support? I once had a problem with verification. The support told me that the essence of the problem was that the system thought I was using a card from a country other than my place of residence. I had to order a card from a different bank. In your situation, it’s worth trying to write to them, in my opinion.

Good day, Olga!

What do they write when withdrawing funds to cards and bank accounts? Or do we specify the purpose of the payment ourselves? Thank you!

Good day, Slava!

When withdrawing to a bank account last year, they wrote “Honorarium,” and then, it seems, at the end of the year, they stopped indicating information in this field altogether. When withdrawing to a card, there was something like “credit merchandise” when I looked a couple of years ago.

Good day! The address has not yet been verified; I am waiting for the letter. I hope it goes through. And regarding account verification, I would like, of course, to manage my money more freely. By the way, I have a side question—what do you think about PayPal? Isn’t it easier to use it? I’m asking because I once created an account there, transferred amounts from the stocks to it several times, thinking I might use it for purchases. Now I decided to withdraw money from there, and everything went much easier and faster, without any problems — I linked my studio’s ruble account, they transferred a small amount there, I confirmed it—and that was it, then I withdrew the whole amount. I just don’t know if there is a withdrawal limit; I didn’t have a need to find out.

Good day, Andrei!

If there are no issues with PayPal during withdrawals, then of course you can use it. Why did everyone get tied up with Moneybookers back then? Because PayPal did not allow residents of former Soviet countries to withdraw money directly + PayPal, as far as I know, does not like to get involved with slippery areas like gambling and Forex. These factors allowed Moneybookers to establish itself with us.

Olga, thank you, you are describing everything correctly and very clearly, but for some reason, the withdrawal procedure is not working for me, even though the card is verified, but the account at Sberbank and the postal address are not verified. The account cannot be verified in any way. I am waiting for the letter with the verification code. I hope it goes through finally. In general, if I understood correctly, I need to complete at least two out of three points—1. Verify the card, 2. The account, and 3. The address. Can you tell me if I understand this correctly?

Andrei, account verification is not required if you have verified your card and address, and you are not interested in a higher withdrawal limit.

Olga, thank you! I generally do everything exactly like that, but I cannot verify my bank account. I suspect it’s because it’s Sberbank. When I try to verify, no amounts come, so I’m left hoping for address verification instead.

Hello Olga! Sorry to bother you, but could you tell me what the maximum withdrawal amount to a debit card is? Support wrote that it’s 500 euros, but when I withdrew, there were no restrictions, and I calmly sent 1248 dollars. Isn’t that strange?! I verified my card and topped up my account with 2.76 dollars. So how much can I withdraw to the card, and will the money reach me now or not? After all, 1248 dollars is more than 500 euros. Or after card verification, are there no restrictions on withdrawals?

Thank you very much for your answer!

Good afternoon, Yuri!

A year or two ago, it was impossible to withdraw more than 500 euros in equivalent. In the last year, I ordered amounts up to 1500 dollars at a time, and everything went smoothly. So the limit for a single withdrawal is likely at least 1500 dollars or more. So don’t worry.

Has anyone faced this situation? Currently, bank account verification is done through deposits, but support stated that I need to send 10 euros and provide a screenshot from the bank. I sent $13.8 from a bank account (not a card number) linked to my Visa card, but there is still no response. Has anyone encountered this and knows if it’s possible to verify a bank account through withdrawals instead of deposits?

Yuri, bank accounts used to be verified through withdrawals. When money arrives in the bank, you needed to take the transfer details, and in the payment designation, there was a verification code… The transfer to the account can take up to 7 days.

I had a similar case, they even blocked my card due to repeated incorrect dates. I wrote to the security service. They replied that I needed to send them a color scan of a document proving my identity (passport, driver’s license). You write a letter and attach a file (check the verification settings). I sent it – 1-2 days later, they responded with a solution and correct dates.

I recommend everyone to withdraw from Skrill to UniCredit Bank. I also struggled with PrivatBank for verification, but here I went to UniCredit, got myself a VISA card (it costs $10 per year), and put another $5 into this account (for Skrill transactions/confirmations), and that’s it. Withdraw without hassle (don’t forget to specify “not for gaming” when linking your card in Skrill). The only downside is it takes a long time, around 4 days, but that’s Skrill’s issue.

alisuch, it takes 4-5 days to get money on the card not because of Skrill issues, but due to the specifics of the Visa payment system.

Good afternoon! I probably entered my date of birth incorrectly during registration! Now I can’t send money! What should I do?

Good afternoon!

1) As an option, try to remember which date you actually entered.

2) You can write to support with details of the problem, most likely you will need to send them a scanned passport. It might take some time.

Can you tell me, is card verification required to receive a transfer to the card where the withdrawal will be made?

Oksana, verification is only required for card transactions. Verification is not mandatory to receive transfers to your Skrill wallet.

Can you please explain! I can’t figure it out! I ask a question in SKRILL from my account, and they reply to my email, but the email only contains a ticket number and NOTHING ELSE!! Where can I find the answer? What is this number??

Serg, could you post the entire email text here? Does the email arrive immediately after creating a request in your account, or after some time (a day, a couple of days)? Maybe it’s just an automated email notification with your request number?

Olya, here’s the situation: I have a Visa Internet card, and the verification and linkage go through without any problems. But when I try to withdraw funds to the card, Skrill asks to pass Verified by Visa verification—when I click the link, a pop-up window appears where I need to enter a code. The bank sends an 8-digit code via SMS, I enter it, but the transaction is declined—so Skrill doesn’t allow withdrawals via the card until I pass Verified by Visa. The bank’s operator confirms that all Visa cards are already verified by the Verified by Visa (system). Have you encountered this problem when withdrawing to a card?

Pavel, have you tried getting a list of one-time codes for your card from the bank or through an ATM? Maybe that would work without SMS. In this situation, the problem could be on either your bank’s side or the bank serving Skrill. If your bank’s card has previously allowed you to make successful payments using VbV, then the problem is on Skrill’s side. If nothing works, you should consider getting a card from another bank, ideally one that isn’t certified for VbV.

People, can someone tell me which banks you use for withdrawals? I’ve withdrawn twice through the Bank of Cyprus, but the third time, the currency department rejected it because there was no payment purpose. Skrill support says they can’t provide a purpose. What should I do?? Thanks!

Maru, try other banks. Or withdraw to a card; in that case, the deposit is processed automatically in 99% of cases, and the purpose isn’t checked due to the specifics of the operation.

Olga, thanks for the article!

You mentioned that Skrill can be “linked” to receive payments on your site.

Could you please explain how?

Good day!

Alexander, to accept payments you need to register as a Skrill merchant or change your current status. Check https://www.skrill.com/en/business/shopping-carts/ for all the PDFs describing the implementation process and steps you need to take.

It only responds to “add a Visa card”…

I click, enter the Mastercard number + code … the screen goes dark

Hmm, so if you click on adding a Visa card, you should add a Visa card. There seems to be an icon for adding a Mastercard, try using that.

I cannot withdraw to Mastercard in Ukraine, UkrSibbank… can you tell me what the problem is?

At what stage is the problem?

In Ukraine, Sberbank of Russia also does not like the payment designation.

barri, try withdrawing to a card instead of a bank account if your withdrawal amounts aren’t too large.

The same story with Aval. For two years, everything was fine with withdrawals. Now they are insisting there’s no payment purpose.

Try smaller banks, which usually cling to every client.

All of this is good, but it does NOT work with UKRAINE!!! Banks reject it with a note for gaming purposes!!! There’s an internal directive that it’s not allowed!!! Such nonsense in PrivatBank, idiots!!!!

Artur, this is a hassle with PrivatBank. I’ve seen information about blocked deposits from payment processors in PrivatBank and requests for contracts. By the way, I don’t remember where I read this, but users have noted that when withdrawing to a PrivatBank account, the transfer was blocked and not credited, while withdrawals to a card went smoothly. I suspect that perhaps they manually process account deposits and therefore filter them. With cards, deposits from payment processors are usually automated.

In general, just use another bank instead of PrivatBank.