How to Complete the W-8BEN Form?

14

In 2009, Shutterstock was the first stock photo bank to begin acting as a tax agent, followed by other major stock banks like Fotolia, Dreamstime, and Depositphotos by the end of the year. How did this manifest? These popular stock photo banks started withholding taxes from image sales.

You might wonder, how can this be? I already pay taxes on this income in my own country! But unfortunately, many countries still have not entered into treaties with the USA for full avoidance of double taxation, so microstockers’ earnings are taxed by the stock banks at rates ranging from 5% to 30% in favor of the American budget.

You can find the complete list of countries that have treaties with the USA to avoid double taxation, along with the applicable withholding tax rates, on Shutterstock’s tax page. Alternatively, just look for the section named Tax Center on other stock banks’ websites to find all the necessary information.

What is the W-8BEN form?

Now, if you are not a US resident and want, for example, to ensure that the Shutterstock stock bank does not withhold taxes from you at the maximum rate of 30%, you simply must fill out the electronic W-8BEN form (Group A2). This form will be used by the Shutterstock stock bank for tax reporting to the appropriate authorities in the USA.

By the way, after filling out the W-8BEN form, the tax withholdings by Shutterstock will be applied only to those sales made by U.S. customers (U.S. source income). Until you complete this form, Shutterstock will withhold taxes on all sales. So, don’t forget about this!

In general, if we examine the withholding tax rates, citizens of Russia and some former Soviet republics (e.g., Armenia, Azerbaijan, Belarus) will not face any tax withholdings, as the rate for these countries is 0%.

Tax withholdings for citizens of Ukraine and the Baltic states (Lithuania, Latvia, and Estonia) will be applied at a rate of 10% (I remind you that taxes are only withheld from sales to US residents).

Please note that Shutterstock’s tax withholding does not exempt you from paying taxes in your home country. The income tax remains the same.

To assess what proportion of your sales come from American buyers, you can visit https://submit.shutterstock.com/payment_history.mhtml?ref=3512 on the Payment History page.

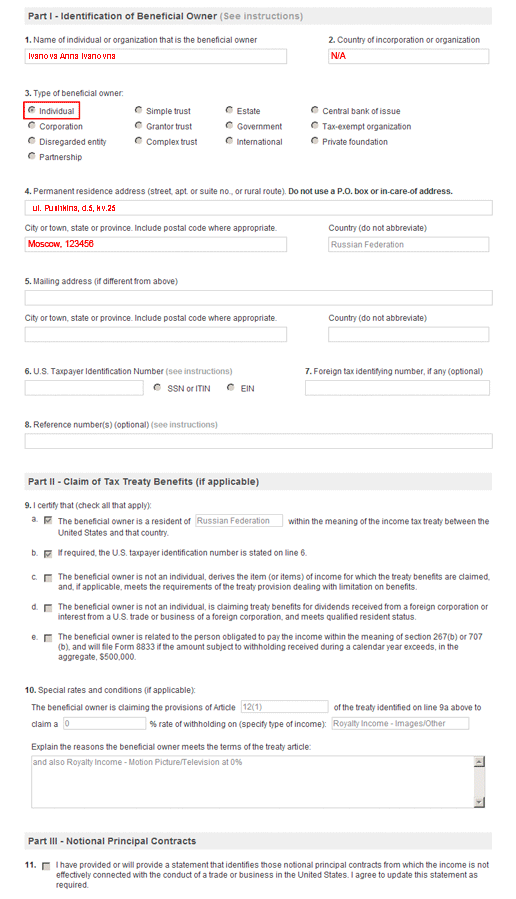

Now, let’s review the W-8BEN form to understand how to complete it. Essentially, filling out this form is straightforward; you just need to be attentive.

Step-by-Step Guide to Completing the W-8BEN Form

- In your Shutterstock account, first verify that your previously entered information – such as your full name, postal code, and address – is correct. If any information is incorrect, update it and wait for verification, which takes about 1-2 days.

- Next, navigate to the Tax Center section and select ‘Submit Form W-8BEN’. Fill in the required fields with the necessary information:

- p. 2 here you write N/A;

- p. 3 here you choose Individual;

- p. 4 this field will already be filled with the address from Your Account;

- p. 5, 6, 7, 8 – leave blank;

- p. 9 – already selected a and b, in point a the country of residence (Russian Federation) is already entered;

- p. 10 – this field is already automatically filled;

- p. 11 – leave this field as is (do NOT check the box);

- at the very bottom of the form, you will need to write Last Name First Name Patronymic just as it is written in p. 1 (instead of a signature).

After successfully completing the W-8BEN tax form in your Shutterstock account’s Tax Center, you will see the message ‘Your submitted W-8BEN has been approved’ within a couple of days.

That’s it; your form has been accepted. You can now continue working with Shutterstock confidently.

Below is the illustration, I provided an example of filling out the W-8BEN tax form for Shutterstock:

Hello, I am a pensioner due to the loss of my breadwinner in Russia, if I pay taxes to our tax office, will I stop receiving my pension? If I fill out this W-8BEN form, will my income information go to the Russian tax office? And will it go if I do not fill out this form and 30% is automatically withheld from me?

Good afternoon. As I have heard, there is currently no complete exchange. But the process is moving towards full data exchange to avoid both double taxation and evasion of tax payments. If you do not fill out the form, no one will transfer anything because tax will already be withheld from you.

Good afternoon! I have a question regarding TIN (as a Russian citizen)

I know that on iStock you definitely need to provide your TIN (they told me that if I don’t specify it, they will take 30%),

but do other stock photo banks have the same conditions?

Yulia, they usually don’t require it.

Hello, please help! When filling out the form, I get an error: Please correct the following errors:

Your digital signature must match the name associated with your account exactly

I am writing my full name letter for letter as in point 1, I have already changed my Account Setting, tried filling out the form in an alternative browser – it still won’t accept it(

Good day!

If you are absolutely sure that you are writing your full name exactly as in point 1 (while paying attention to the keyboard layout, CapsLock, and spaces), and you still receive this kind of error, I recommend contacting Shutterstock support.

Good luck!

Hello, I am from Belarus.

As I understood from your list, Belarus has an agreement with the USA to exclude double taxation. I filled out and sent the W-8BEN form.

Did I not need to do this?

Thanks in advance for the reply.

You did everything correctly. If Belarus has an agreement with the USA (by the way, didn’t it automatically apply the tax quota for you?), you will not be charged double tax on purchases made by Americans.

Good luck!

Hello. I am a citizen of Ukraine and I have a question: how do I understand how much and where to pay taxes based on my residence? Should I go to the tax office and say that I work for Shutterstock, and they will tell me what and where to pay?

Good afternoon!

I would recommend that you first schedule an appointment with the tax inspector at your place of residence and clarify all the details there. There’s no point in telling the inspector that you work for Shutterstock or another microstock, as it often holds no significance for them. You can simply say that you work on orders via the internet. You receive payments to your bank account. You are not an entrepreneur. You want everything to be official, and let them explain what you need for that. You could also mention that taxes are withheld from your earnings for orders from the States to avoid double taxation. But I’m not sure how they will respond to that. If you find out anything, please write in the comments; I’m curious.

Generally, as far as I know, at the end of the tax period, individuals who are not entrepreneurs and receive income not from their primary place of work, or receive unofficial income, need to fill out a tax declaration and submit it (send it by mail; I think even by email is allowed in some countries) to the tax authority at their place of residence. You will need to pay income tax on all unofficial income (in Ukraine, it’s around 15%). Tax payment is made through a bank.

Thank you! Great article, it helped me!