Filling Out the Tax Form on 123RF

2

Recently, the 123rf stock site has also required mandatory completion of the W-8BEN tax form from its contributors, just like other major stock photo sites. I have previously written about how to fill out this form using examples from other stock sites, so if needed or for comparison, you can check here (for iStock example), here (filling out the form on Shutterstock), or here (example with Depositphotos).

Today, I will explain the procedure for filling out this tax form on 123RF.

How to Fill Out W-8BEN on 123RF

Basically, if you look at my previous reviews on this topic, it will be clear that the form is standard, and the main difference lies in whether the stock photo site’s interface allows you to fill out the form online or upload a file with the already completed W-8BEN form.

So, first, log in to the stock site. Go to the 123RF Tax Center section, where you need to select the IRS Form W-8BEN | Group A2, A3 or B2 (right column, first from the top in the column) and click on Online W-8 BEN Form.

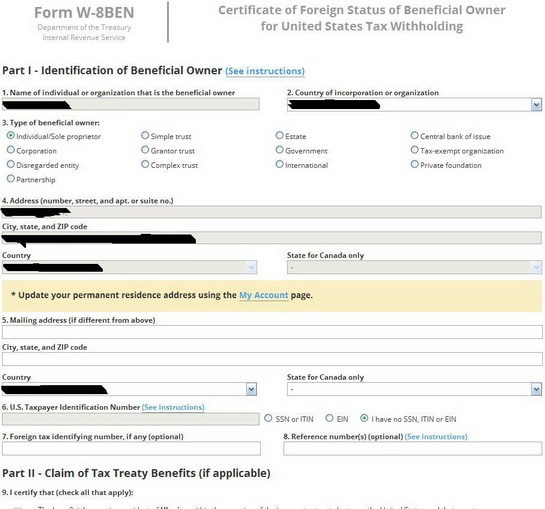

A new window will open in your browser showing the form with fields to fill in.

Your profile information will be automatically entered into the corresponding form fields. Here is approximately what it looks like for me (I have shaded my personal data):

So, proceed according to the following algorithm:

Item 1: check the correctness of the auto-filled first and last name (though there is no option to correct it there).

Item 2: check the correctness of the country of residence specified (you can choose another from the list if necessary).

Item 3: check the box for Individual/Sole proprietor.

Item 4: check whether the address where you are registered (officially residing) is filled in correctly.

Item 5: fill in if your actual address differs from the address of registration specified in item 4. By the way, if you have changed your place of registration, you can update this information on the My Account page.

Item 6: check the box for “I have no SSN, ITIN or EIN.”

Leave the other items as they are.

Next, be sure to check the box in Part III and correctly rewrite the first and last name from item 1 into the very bottom field.

Click Submit.

Then you will see a thank you message for filling out the tax form.

That’s all. It is quick and quite simple this way.

This article is available in the following categories: 123RF, Finance

Thank you very much 🙂

By clicking on one of the options, an instruction will open that will help you determine which group you belong to and which tax form you need to fill out.