How to withdraw money from PayPal via Payoneer?

52

Some time ago there was a post about the Moneybookers payment system, and financial topics were not revisited after that. Today the plan is to return to finance again. One of the most popular online payment systems is PayPal.

However, for many years this popular system has restricted functionality for residents of developing countries. This discrimination seems puzzling, especially given that even citizens of India can fully use PayPal, while others still cannot withdraw funds from PayPal and are limited to deposits only.

It is frustrating, because there are promising stock photo sites and other freelance income platforms that only work through PayPal, yet cashing out PayPal funds seems impossible. Meanwhile, for example, Skrill allows all such operations, even though the company is based in the UK, which also has relatively strict financial rules.

By the way, there was already a post about withdrawing funds from Moneybookers, and as can be seen from that article, there are no special difficulties with it. Many people, however, work with PayPal through various intermediaries such as exchangers, private individuals, etc.

It turns out there is also a relatively straightforward method that does not require dealing with third parties of uncertain reputation. This article explains that method.

The above method for cashing out funds works as follows. Money is withdrawn from PayPal to an account with Payoneer, from which the funds can then be cashed at an ATM (terminal) using a payment card or used to pay for purchases.

The total fees are relatively low compared to online intermediaries, who may charge up to 20% of the amount to withdraw money from PayPal. To be clear, this is not the first description of such a workflow. Similar overviews have been seen in a more concise form on other sites. So, here are the details:

About PayPal

Let’s start with what is known about PayPal. Some know a lot and some know nothing, yet English‑speaking online business users—brooch designers on etsy.com, apartment owners on craigslist.com, vinyl sellers on eBay.com, or forex traders—are all using “the pal” (a colloquial nickname for PayPal), so this article begins with an overview of this payment system.

An account in PayPal is linked to a user’s bank card or bank account. Until the bank card details are added in the account, the account is treated as unverified.

A user can receive and send money from the funds held in their PayPal balance, and if the balance is insufficient, PayPal will charge the linked bank account or card when paying.

Thus, deposits/withdrawals exclude any intermediaries, and funds are not idle—they can be transferred to the user’s bank account at any time.

PayPal accounts come in three types:

- Personal Accounts;

- Premier Accounts;

- Business Accounts.

Personal Accounts

For individual use only (direct transfers to friends, relatives, clients, etc.). This account type does not accept credit card payments and is intended for internal transfers within PayPal.

The turnover limit for these accounts is $500 per month. For an unverified account opened from Ukraine or Russia, the limit is $100 per month. Exceeding it may result in account blocking.

Moreover, as stated above, accounts opened from Ukraine or Russia cannot receive transfers within PayPal, regardless of account type.

Premier Accounts

For users with higher turnover than a Personal Account allows, and who need to accept credit card payments or use special PayPal tools (for example, integrating PayPal with a website).

Business Accounts

Accounts for companies. They are issued in the company’s name, with its logo and details. Such accounts can only be opened by companies with a TAX ID (taxpayer number).

Registration with PayPal

Signing up with PayPal is fairly easy:

- On the first page of the registration form, select country of residence and preferred interface language.

- Next, choose one of the three account types (see above).

- On the next page, enter name, correct mailing address, email, and phone.

- After that, enter credit or debit card details. This step can be completed later. A necessary condition is that the issuing bank allows online payments. By the way, a virtual VISA card is sufficient for registration and can be opened in almost any bank.

- At the final stage, verify the email address: PayPal will send an activation code. Follow the link and confirm the action by entering the chosen PayPal password.

The account will not be activated until a special code—the membership number—is entered on the site. To do this, top up the account by bank transfer or card payment.

A $1.95 membership fee will be charged to the credit card, which will be refunded later. A billing receipt for the $1.95 charge will arrive at the provided mailing address. It contains a special code that must be entered in the account to activate it.

After full verification of the mailing address, email, and credit card, the $1.95 will be returned as a bonus, full PayPal functionality becomes available, and purchases within the system can be made.

Each PayPal account type has its own fees, which vary not only by account type but also by the country of registration. For example, a US business account is charged one commission, while the same account registered in Australia or Europe is charged another).

The lowest fees are for users in the States. The transaction fee is charged to the payment recipient.

PayPal services

PayPal offers the following services:

- Send Money. A PayPal user can transfer a specified amount from their personal balance. The recipient can be another PayPal user or someone without a PayPal account.

- Money Request. Using this service, a user can send messages to debtors requesting payment. A message can be addressed to a single person or a group of debtors.

- Web Tools for accepting payments on a user’s website. This service is only available to Premier and Business accounts.

- Auction Tools. The system offers two services. First, Automatic Payment Request. Second, auction winners can pay directly on the auction website (Instant Purchase for Auctions).

It is a bit dry, but now there is a clearer picture, and knowledge is power, so let’s put it to use!

If everything above was read carefully, then the very first stumbling block is likely the requirement to link a bank card or bank account, which may not yet be available—otherwise this article would probably not be needed.

So it is premature to register with PayPal: first, a bank card or account suitable for linking to PayPal must be obtained. This is where the helpful service payoneer.com comes in.

The Payoneer payment service

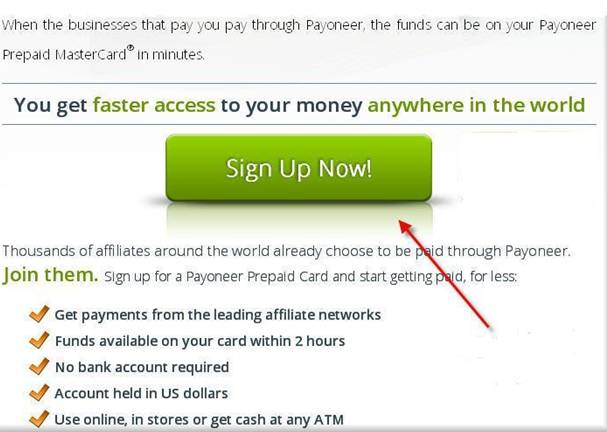

Here is what they say in their promo video:

Can Payoneer be trusted? At present, more than one million people in over 200 countries use the Payoneer MasterCard. Recently, Payoneer has been actively expanding in the Russian market.

The core service is simple: payees (freelancers across niches), using a link received from a Payoneer partner company, confidently order a reloadable MasterCard. Payoneer reciprocates by issuing a fresh, shiny card and mailing it to the applicant.

After receiving the card, the payee must activate it at payoneer.com, after which funds transferred by the payer (the partner company) to this card can be withdrawn at any MasterCard ATM or used for in‑store and online payments.

The card is embossed and issued for three years. It is USD‑denominated. Access to card statements is available on the Payoneer website.

Payoneer support is available by email, phone, and online chat in several languages, including Russian. So if the plan is to be serious and long‑term online, it is time to get a personal piece of plastic—life will be brighter and easier.

Here is how to do it—having said “A,” it is time to say “B,” and all the remaining letters in the word – payoneer.com. Recently there was a chance to go through the registration process in Payoneer.

Registering with Payoneer

Now for the paperwork routine—it is the usual flow: there is a Russian‑language registration option, but that’s for beginners, so the defaults were used – English locale.

On the site, go to the – My Account tab:

Click Sign Up Now, which leads to a page where the eye immediately lands on the green rectangle labeled Start Here – starting with no risk to life

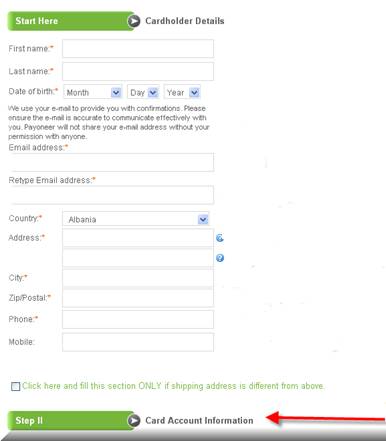

Next is a simple personal data form—fill it in and double‑check carefully so “Ivanov” doesn’t become “Ibanov,” etc., then proceed to – Step 2

Again, all is predictable: verify email, set a password and a security question for recovery, then as usual – Step 3

Here is an interesting bit: you must enter a National ID—what is that and where to get it? It simply means providing details from an additional ID document (driver’s license, social security number, etc.).

Also, do not forget to select the country and tick all the checkboxes confirming agreement with the terms, and then click Finish

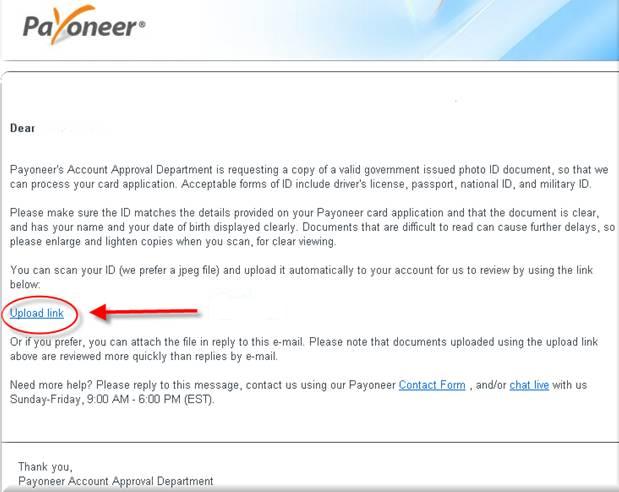

If everything was done as shown, expect an email requesting a scan of the document corresponding to the National ID provided during registration.

Here is a rough translation of that email:

Dear Ivanov,

The Payoneer Account Approval Department is requesting a copy of a valid government‑issued ID so we can process your card application.Acceptable forms of identification include a driver’s license, passport, national ID card, or military ID.

Please make sure the ID matches the information provided in your Payoneer card application and that the document is clear, showing your name and date of birth.

Hard‑to‑read documents may lead to delays, so please enlarge and enhance contrast when scanning to ensure a clear image.

You can scan your ID (JPEG files are preferred) and upload it automatically to your account for our review using the link below:

Add link

Alternatively, you can attach the file in a reply to this email. Note that documents uploaded via the link above are reviewed faster than email replies.

Need help? Please reply to this message, contact us using the Payoneer contact form, and/or chat live with us Sunday through Friday, 9:00 AM – 6:00 PM (EST

And here is a screenshot of that email, with the link to continue registration with Payoneer:

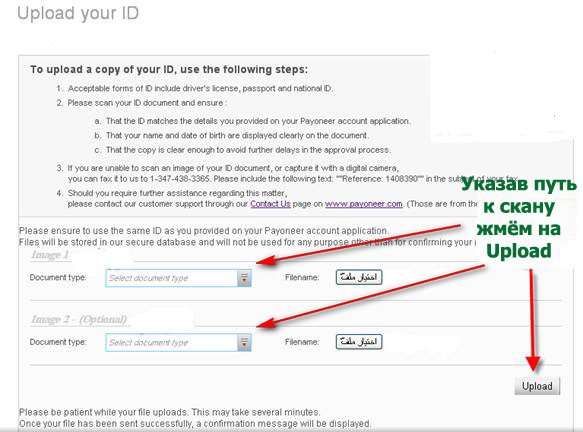

There is a redirect to the page for uploading personal images of the National ID

Now it is time for patience while waiting for manual approval, which can take from 1 to 5 days (depending on the clarity of the National ID—i.e., the quality of the uploaded scan).

If approved, an email will arrive stating that the application has been accepted and the plastic is on its way to the designated address:

Dear Hicham,

Congratulations!

Your Payoneer Prepaid Debit MasterCard® card order has been approved!

Estimated arrival date for your card is July 10, 2012

There are 3 steps to be completed:

Step 1: Registration » completed!

Step 2: Approval » completed!

Step 3: Delivery » You are here!

Estimated arrival date for your card is July 10, 2012

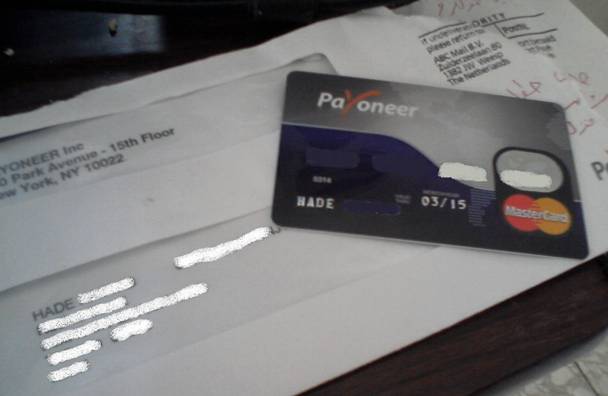

Now it all depends on the postal services along the card’s route. Delivery times for a Payoneer card vary (in this case it took two and a half weeks).

And here is the fruit of the effort: an envelope with the card and an A4 pricing sheet with all card service fees (terms and conditions):

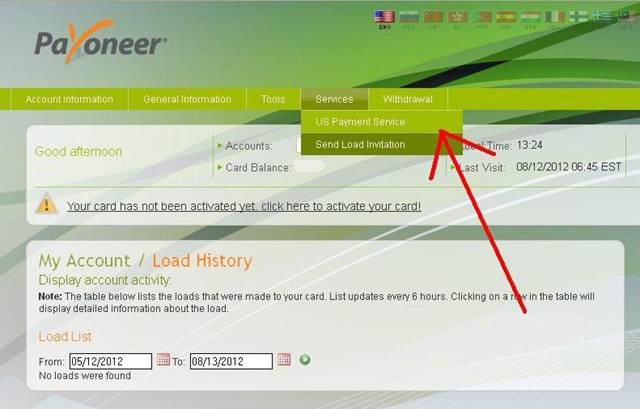

A little more patience is needed to bring the card to life—i.e., activate it. To do this, log in to the Payoneer account and click Services => US Payment Service:

Click the green “Active” button. The flow changes from time to time, but typically a XXXX‑digit security code (PIN) from the back of the card must be entered.

Next, a message appears with the personal account details within the Payoneer payment system (apologies for the image quality in some screenshots):

That’s it—the card can now be funded and cash can be withdrawn via ATMs. All the steps above, including mailing the card, are free of charge.

However, at first funding an activation fee was charged, which is usually 10 dollars. This is a one‑time payment; after that, only the monthly maintenance fee is charged, which generally does not exceed 3 dollars.

These fees depend on the partner through whom the card was obtained. Some do not charge an activation fee at all, while others have a monthly fee of just 1 dollar. When choosing a partner, make sure to check their pricing.

Here is a list of those who officially support and issue Payoneer cards (to receive a card from such a partner, income must first be earned there; once the minimum payout threshold is reached, the card will be offered as one of the payout options).

Stock photo agencies:

veer.com

istockphoto.com

dreamstime.com

Banner (media) ads:

mediawhiz.com

mediashakers.com

dsnrmg.com

smowtion.com

oridian.ybrantnetworks.com

Freelance exchanges:

www.elance.com

www.rentacoder.com

www.odesk.com

www.vlancers.com

www.limeexchange.com

www.guru.com

www.utest.com

www.freelancer.com/

Payment gateways:

plimus.com

2co.com

tripleclicks.com

fastspring.com

avangate.com

epese.comAffiliate programs:

buy.at

convertclub.com

roirocket.com

conduit.com

ethosworld.com

convert2media.com

copeac.com

Network marketing:

freedomrocks.com

kyani.net

visalus.com

xsura.com

wellnesspro.com

alivemax.com

worldventures.com

textlinksads.com

infolinks.com

reviewme.com

Forex:

avafx.com

etoro.com

SMS billing:

smscoin.com

Technical support (outsourcing):

ixya.com

Withdrawing to a Payoneer card

Loading funds to a Payoneer card is quite fast. There is either a standard load, which can be free but takes 1–3 days, or an instant load, which costs $3–$5 but makes funds available immediately.

ATM cash withdrawals with a Payoneer card cost $2.15 + up to 3% of the amount for currency conversion. In practice, for withdrawals over $500 the total fee is fairly modest.

It is also possible to fund Payoneer via WebMoney. For this, a third‑party service is needed, such as www.epese.com. The card should be linked to the Epese account in the usual way, and a support ticket sent specifying the card number and the partner who issued the card.

After that, the card will be fully linked to the account, and any funds received to the account via WebMoney or another payment system can be withdrawn to it.

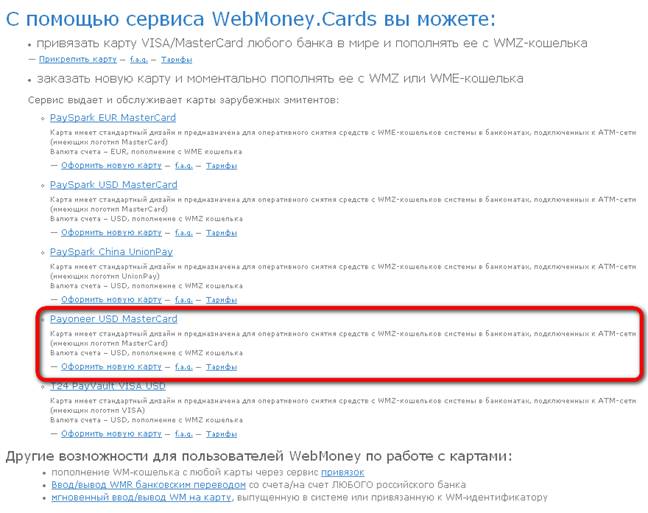

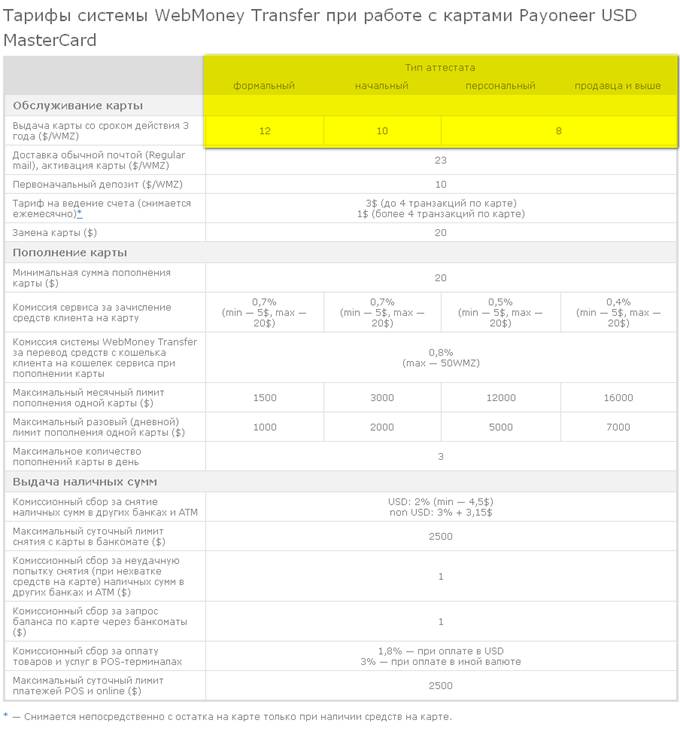

The card loading fee is 1%, but not less than $5. So again, it is preferable to transfer amounts of $500 or more. Although WebMoney also issues Payoneer cards, as stated on their site – cards.wmtransfer.com/ru:

Pay attention to the fees column, where there are small formalities typical for WebMoney—in particular, with a BL less than 8, a card cannot be obtained:

Other details can be found in WebMoney’s help section on their site. However, there may be further issues linking such a card to PayPal; therefore, if the goal is not PayPal cash‑out but simply withdrawing funds within the CIS, it may be fine, but relying on luck is not advisable, so Payoneer cards are obtained via the official site.

All Payoneer card activity can be easily tracked in the account. If questions arise about card servicing or other nuances, solutions can be found on the forum page – community.payoneer.com/forum/ – which has a dedicated Russian section:

So, the card has been activated, bringing us about 80 percent of the way to the goal—cashing out from PayPal—but there is no need to rush. It is best to wait a bit so the plastic “settles” for at least 3–5 days.

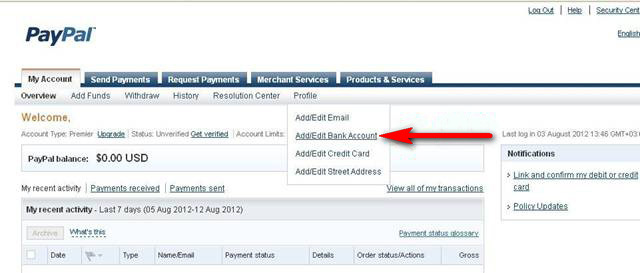

Now it is time to complete the process logically by going to the PayPal dashboard to link the newly minted card. In the profile, select Add/Edit Bank Account:

If the option to add an account is missing, consider the advice given by a reader in the comments to this article:

“Nothing has been shut down. Everything works fine. The only caveat, unrelated to Payoneer, is a PayPal quirk: when adding a bank, you will have to call support.

You will also have to call support when confirming email. And finally, when adding a card, you will have to call support. They approve all such requests manually.”

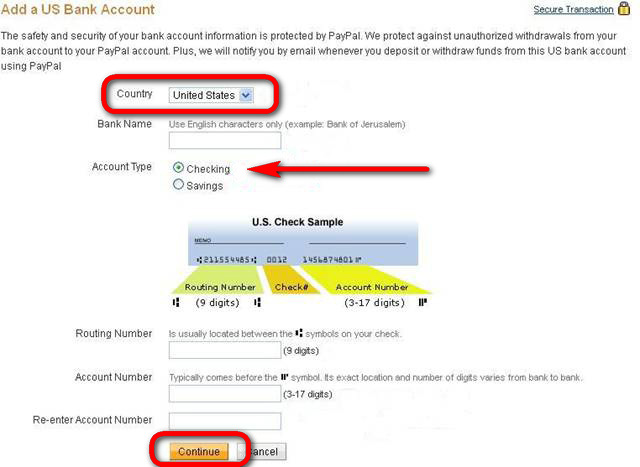

Carefully enter the card details and select the country – United States. The bank name and required account numbers can be found via the link in the account: https://myaccount.payoneer.com/MainPage/VirtualUsAccount.aspx.

Remember that a sapper makes only one mistake—so triple‑check every field:

Only after careful verification click Continue, after which a standard proficiency check awaits—GET VERIFIED via two automatic micro‑deposits to the Payoneer account.

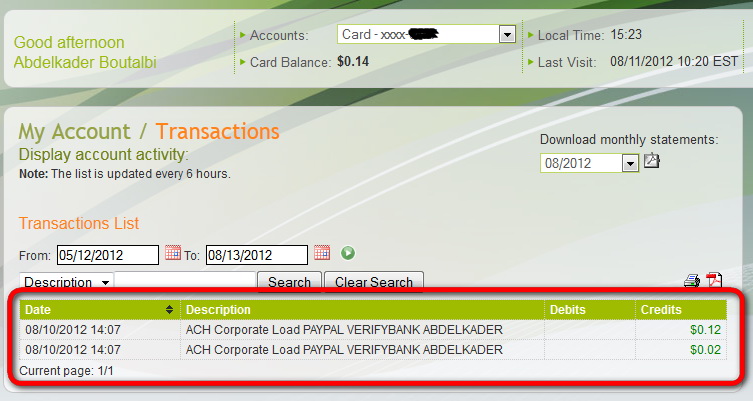

Now check the virtual Payoneer bank account and find two mini‑deposits under one dollar each (0.12 and 0.02):

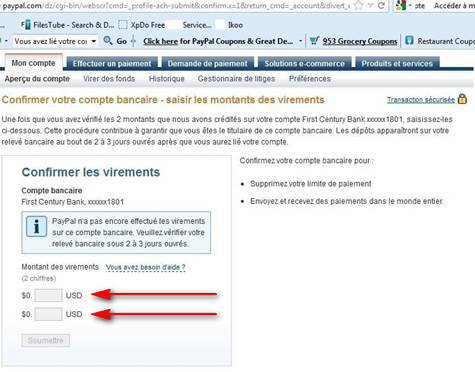

Return to the PayPal account, where there is a prompt to report the micro‑deposits—provide the amounts:

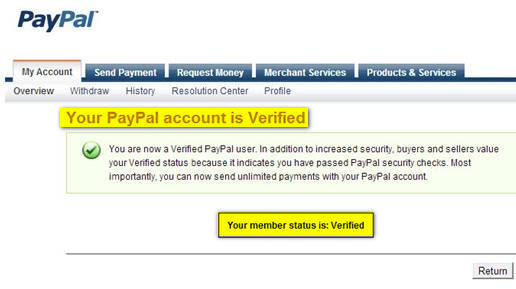

And here is the light at the end of the tunnel—PayPal has been verified. The option is now available to “feed the plastic with green” (ADD FUNDS):

That’s how, with steady hands, a bit of patience, and a detailed navigation route, an ordinary piece of plastic becomes a Payoneer mega‑card with the ability to TRANSFER almost anywhere in the United States. Congratulations, the PayPal account works.

By the way, the Payoneer plastic card will arrive at the address provided during registration, so it is better to specify an address where the card can be reliably received. This address is also used for certain online card operations.

Later, if the address changes, it can be updated in the account dashboard or by contacting Payoneer support. In general, there are two address fields—the registration address and the address to send the card to, i.e., the shipping address—while the official address (registration) will be used as the billing address.

Also, to expedite delivery of the card, in the shipping address write the address in the usual local format but in Latin characters, for example, Ulitsa Bolshaya Dom 5 Kvartira 88, which is clearer for postal workers, and delivery speed mostly depends on them.

Use this door carefully while it is still open, but everything changes.

The material in this article is explained in detail and should be useful to those looking for the least expensive ways to withdraw money from PayPal. This workflow has not yet been tried personally, but perhaps it will be—some funds may be cashed out via PayPal.

P.S. Please note that this article about linking PayPal and Payoneer was written in 2013; over the years, a lot has changed and the material may well be outdated by now.

This article is available in the following categories: About Microstocks, Finance

I was able to withdraw $2000 without additional fees and conversions. I previously selected the required currency in the section – myaccount.payoneer.com/MainPage/Widget.aspx?w=StoreManagement#/relations/storemanagement. The bank’s ATM dispenses up to $500 at a time.

Hello, I was looking for a solution for a partner store in the international market, what payment method to connect, many services provide such services, I have contacted various ones, but tech support did not inspire confidence almost anywhere, and the reviews were also poor. PayPal is a more reliable payment acceptance system, but it does not work in Ukraine. Given this situation, I concluded that the most reliable and least costly way to accept payments (since the dropshipper is on a commission) would be a direct bank transfer or directly to the card. This payment method is safe, but the natural question arose: how will such a scheme work? Will it be convenient for users to pay for goods this way? Is it possible to make payments to an internet card (in currency) or via direct transfer from anywhere in the world?

Please share your experience on this issue; thank you in advance!

Good afternoon!

Connect to some payment aggregator and start working. There are Portmone and others in Ukraine that you can collaborate with.

I have a situation: I received a Payoneer card and created an American PayPal account. To register it, I had to provide a false phone number from the USA. But now I can’t access the account because it asks to confirm the phone number. Please tell me how I can receive payments from Etsy. Payoneer was not linked to PayPal. Besides, I have a Ukrainian PayPal account linked to a PrivatBank card. I kindly ask for your advice via email at alkanator13@mail.ru

Valeria, PayPal needs an account from a country where PayPal works for withdrawals, and you also need to have the ability to confirm it. In your case, if such an opportunity is not available, I recommend considering the possibility of working with intermediaries like seller-online.com, westernbid.com, and similar services.

Does not register PayPal Payoneer. Only Russian cards. I registered a Yandex card

PP support replied: I’m sorry to hear that you were unable to add your bank account to your profile. This is because the bank you were trying to add is a Payoneer account. Due to our recent updates, Payoneer accounts may not be linked to a PayPal account anymore. In short… PayPal no longer supports Payoneer bank accounts… So you can all relax and close the topic.. The free ride is over….

Well, everything ends at some point… Two years ago, at the time of writing the article, the scheme was working perfectly.

The PayPal account in the States, the Payoneer card has been received… USPS activated… The problem now is that PP doesn’t want to accept it. These are the things… I wrote to support… Let’s see what they reply…

Hello! The employer transferred the money. I used instant crediting, meaning the money is in the account. I tried to make a purchase in an online store – it doesn’t work (everything is fine with other cards). The amount is in euros, but I heard that there is automatic conversion. So if I can’t pay with my card, can I withdraw the money? I can’t reach support.

Good day!

Irina, have you checked the balance on your card? If everything is fine with that, then try contacting the bank that issued the card. They can check the reason for the payment denial in the store. At one point, for example, there was an issue where some banks required you to cancel the CVV code verification over the phone to avoid a denial.

I called PayPal; they said everything is possible. Over the phone, they said that the money arrives in rubles and is converted at the Central Bank of Russia’s rate, and withdrawals can be made to the account (which is available with every bank card). The only downside is that they charge a commission of about 3% for the transfer (you need to confirm this).

Guys, I did everything as indicated in the article (although I followed a different article, but that’s not important). Now I can’t add a bank account because I have a Polish PayPal, and the address is different from that on my Pioneer card. The debit card was added without problems, but I’m unclear on how to add a bank account now. In Pioneer, adding a second country is not allowed. In PayPal, you either need to show a passport (I live in Ukraine) or accounts. Has anyone solved this issue?

Yeah, you’ve really tangled up the story. Perhaps one of the readers from Ukraine will comment on your situation.

Hi) If I withdraw money from Payoneer via an ATM, is the exchange to hryvnias based on the bank’s exchange rate? Or how does it work? Please explain.

Hi!

No, based on the payment system’s rate. Here is, in fact, the answer from Payoneer on this matter (whether for purchases or withdrawals, there’s essentially no difference):

” How is my foreign exchange (FX) rate determined?

When using your Payoneer card to make purchases in a foreign currency, the transaction is converted based on MasterCard’s® official exchange rates (or VISA, depending on your card’s issuer). Please note that exchange rates are constantly changing throughout the day, and the rate is determined at the time of purchase.“

Since September 16, 2013, within the framework of the NPO (non-bank credit organization) license in the Russian Federation, adding a US bank account to a PayPal account is impossible.

Elena, as far as I understand, this is about not receiving a PayPal license for Russia. For example, as mentioned in comments from Ukraine, they also cannot add a bank account using standard methods to their account.

Great article! I just don’t understand, before linking the card to PayPal, it should already have money on it… What to do?

Should the PayPal account be American? How can I confirm the verification if they ask for SSN, for example?

Anton, when I went through this procedure, everything was working fine. Regarding registration from an American IP, I personally haven’t tried that, but readers in the comments said that it works. Maybe they just entered a set of numbers when requested for SSN, or there was no request at all?

I have the “Bank Accounts” section unavailable.

My account is Ukrainian!

Now I have to open a new account in America?

Most likely yes, or try calling tech support. But probably it’s easier and cheaper to try the first option.

Good afternoon! I want to link my Payoneer card to PayPal. I go to the profile to add a bank account and it says, “The “Bank Accounts” section is unavailable. PayPal does not currently offer this feature.” How can I solve this problem? Should I call tech support or register an account in the US? Thanks!

Good afternoon, Artem!

Based on reader feedback, both options are feasible. But it might be easier to register a new account based in the US.

People from Ukraine, Belarus, Kazakhstan withdraw without any problems to Payoneer via PayPal USA!

Everything’s OK. The money arrived on the card 3 days after I requested the withdrawal from PayPal! Everything works 🙂

Everything works fine. The only issue not related to Payoneer is a PayPal feature: when adding a bank, you have to call support. Similarly, when confirming an email, you have to call support. And lastly, when adding a card, you have to call support. They manually confirm all requests.”

How do I do that? Do I have to call?

Well, either call, or as Vaasili suggested, try registering the account as if it were from the US.

Registered a new account through the US, linked a bank account, and got a $500 monthly limit! To register an account through the US, clear your cookies, enter a real US address and phone number, and where it asks for bank account details, don’t enter anything. Use your real first and last name—that’s what I did! Requested a $100 withdrawal and waiting for it to arrive. I’ll update!

Okay, I’m curious to hear the results of this experiment.

((( What should I do if I’m from Belarus and linked a Belarusian card to PayPal, but registered the PayPal account through Lithuania? They’ll block my wallet right away!!!((( Frustrating.

Well, an option could be to try contacting support. I’m not sure how things are with this now, but a few years ago, I remember hearing stories of students registering PayPal accounts from the US, returning to their home country, and getting their accounts blocked.

Received a card and trying to link it to PayPal, but it shows an error and says that the account cannot be added at this moment, please try later!

I read in your article that the card should “settle” for 1 day. Is there a chance that the linking will go through after 4-5 days? Or has this option been closed off for good?

Yes, things are a bit complicated right now. According to one user, it works like this: “Nobody closed anything. Everything works fine. The only thing not related to Payoneer is a PayPal issue: when adding a bank, you have to call support. Similarly, when confirming an email, you have to call support. And lastly, when adding a card, you have to call support. They manually confirm all requests.“

Thank you so much for the advice)) If it weren’t for you, I’d have been stuck on this for ages!!

🙂

Thank you very much for the interesting information. I understand that experience comes with time. So, let’s keep trying, and I hope something will work out eventually. They sent me a card, but I don’t know what to do with it next. Regards, Zhanat.

Good luck!

How do I add a U.S. bank account to my PayPal account?

Since September 16, 2013, as part of the NKO (non-bank credit organization) license in the Russian Federation, adding a U.S. bank account to a PayPal account is not possible.

https://www.paypal.com/helpcenter/

Yes, I’ve heard, but besides Russia, there are several other post-Soviet countries where PayPal still hasn’t started working directly, so this method may still be relevant for them.

Nobody has shut anything down. Everything is working perfectly. The only thing, which is not related to Pioneer, is PayPal’s quirk: when adding a bank, you will have to call technical support. Also, when confirming your email, you will have to call technical support. Lastly, when adding a card, you will have to call technical support. They confirm all requests manually.

What is it that they have tightened the order of addition?

Could you please tell me how to link a bank account if this function is unavailable for residents of Ukraine? I have attached a screenshot.

It seems that they’ve shut the shop down :((

Hello everyone!

I don’t have the link “Add/Edit Bank account.”

Has the interface been updated, or is there only Profile – My money – Link bank, and then it asks for “Sort code

6 digits”?

Tell me what to do, maybe I have limited rights.

I can’t find the “Add US Bank Account” page…

God, I’m already depressed! PLEASE HELP ME.

Can you tell me, is the second step – National ID – really a required additional document? Or will a Russian citizen’s passport be enough?

Anatoly, a passport will be quite sufficient. Just make sure to enter the data correctly.

For this line “choose a country – United States,” if it does not correspond to reality, you will be banned on PayPal and will have to forget about your money.

Leonid, where did you get this information? Do you have examples of such bans?

Sorry, I’m confused… when transferring funds from PayPal to Payoneer, what bank name should I write, and where can I get the routing number and account number?

Thank you in advance)

I forgot to mention this in the article. Oxana, please check the link https://myaccount.payoneer.com/MainPage/VirtualUsAccount.aspx, there you will find everything you need for linking.

P.S. I added the information to the article as well.